tax deductions for high income earners 2019

Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income. The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest deduction 63 billion.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Equal to or below 182000.

. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Ad Prepare your 2019 state tax 1799. Normally AMT is taxed at a flat rate of 26.

For 2018 the maximum elective deferral by an employee. 1 2019 the maximum earnings that will be subject to the Social Security payroll tax will increase by 4500 to 132900up from. If youre 50 or older the limit is 6500.

Roth IRA Contribution Limits for 2019 and 2020. Under reasonable assumptions about behavioural responses to taxation the Laffer curvewhich shows the relationship between the tax rate and tax revenuespeaks around 60-75 percent for high. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income.

IRS Tax Reform Tax Tip 2019-28 March 21 2019. Establish a donor-advised fund. Check For the Latest Updates and Resources Throughout The Tax Season.

In the short run high marginal tax rates induce tax avoidance and tax evasion and can cause high-income earners to reduce their work effort or hours. PdfFiller allows users to edit sign fill and share their all type of documents online. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions.

Roth IRAs are incredibly attractive as they have tax-deferred growth and tax-free distributions in retirement. In 2019 that rises to 6000 and 7000 respectively The limits for 401 ks are much higher. Income over 194800 Joint Returns individual returns estates and trusts.

For example in 2020 we plan to deduct all of the following from our taxable income. Lets start with retirement accounts. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions that affect the high income earners retirement planning and tax planning strategies.

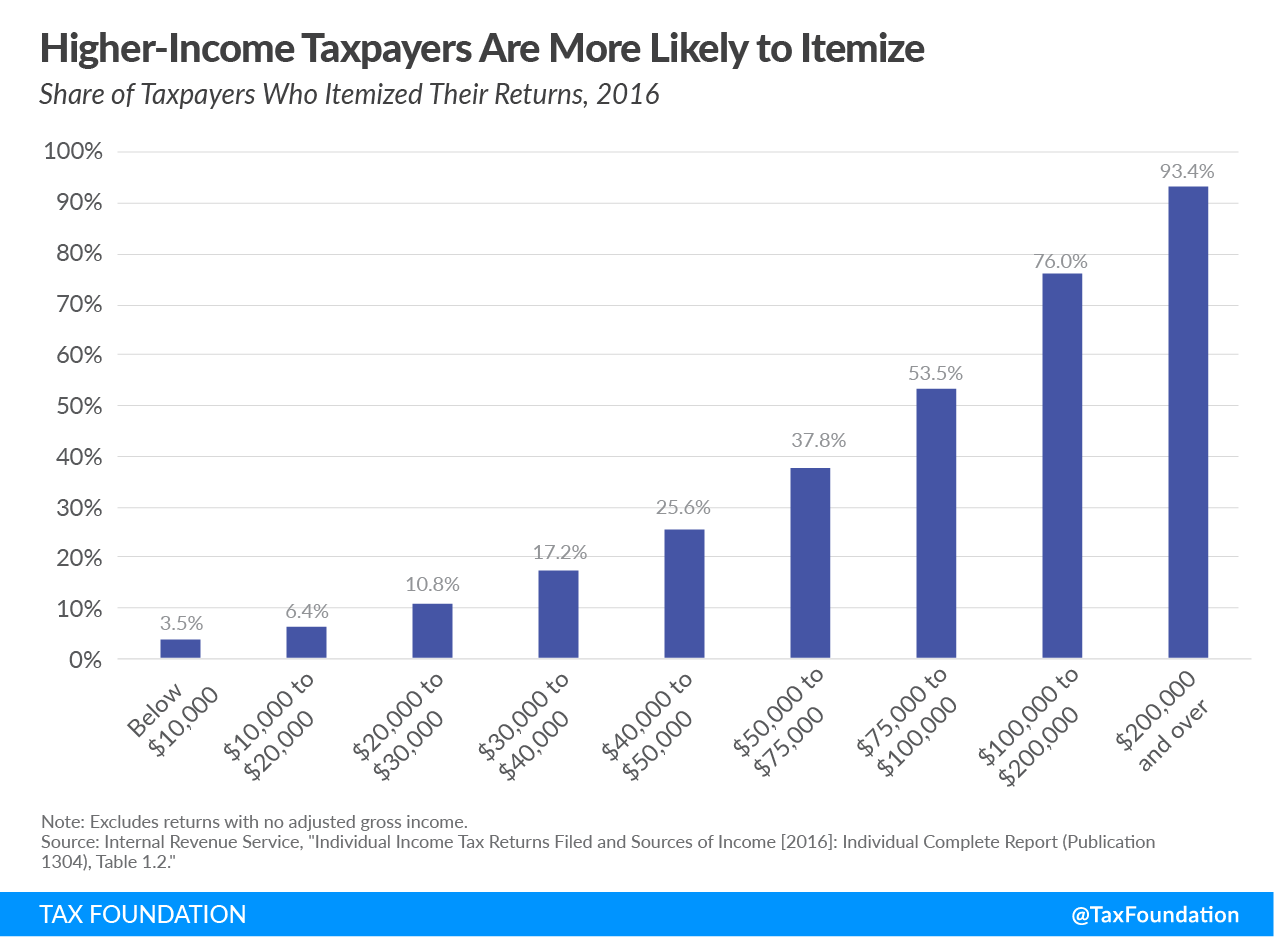

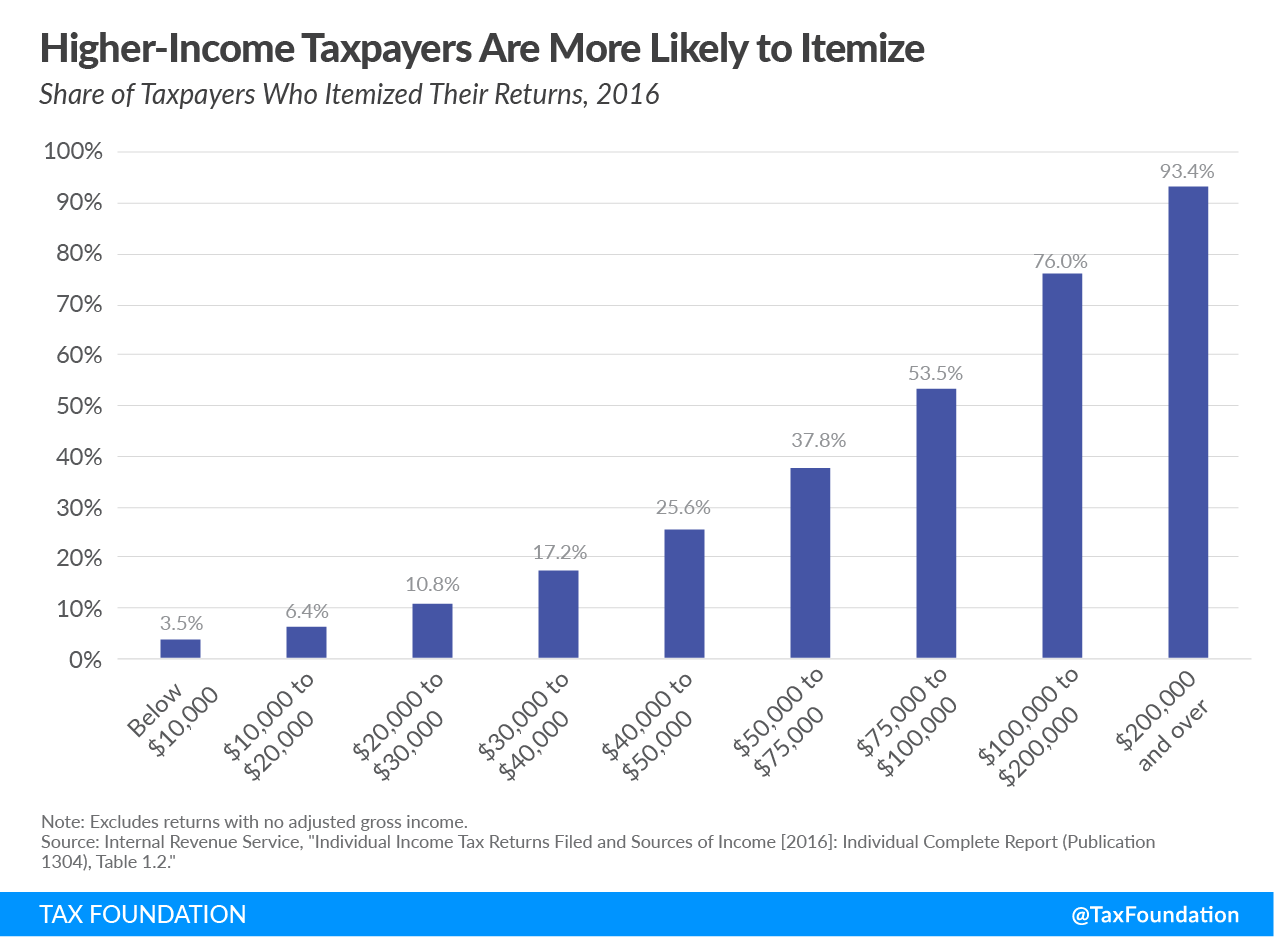

One of these changes is that TCJA nearly doubled the standard deduction for most taxpayers. You can deduct up to 60 percent of your adjusted gross income each year for gifts of money. This means that many individuals may find it more beneficial to take.

If you are expected to pay IRMAA SSA will notify you that you have a higher Part D premium. Ad 4 Ways Your Tax Filing Will Be Different Next Year. 28 AMT Tax Bracket.

The article below was updated on Dec. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. The contribution you will make.

The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The contributions will still appear on IRS Form 5498 and may qualify some low- to moderate-income earners for the savers tax credit.

Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they filed in previous years. If youre charitably inclined charitable contributions can provide outstanding tax benefits. Here are 9 ways to accomplish your goal and reduce your tax bill.

Understand The Major Changes. The Tax Cuts and Jobs Act the tax reform legislation passed in. You may take an itemized deduction for contributions of money or property to a tax-qualified charity.

On the other hand tax-deductible contribution limits to a Solo 401k are very high. For example a single filer making 523601. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post.

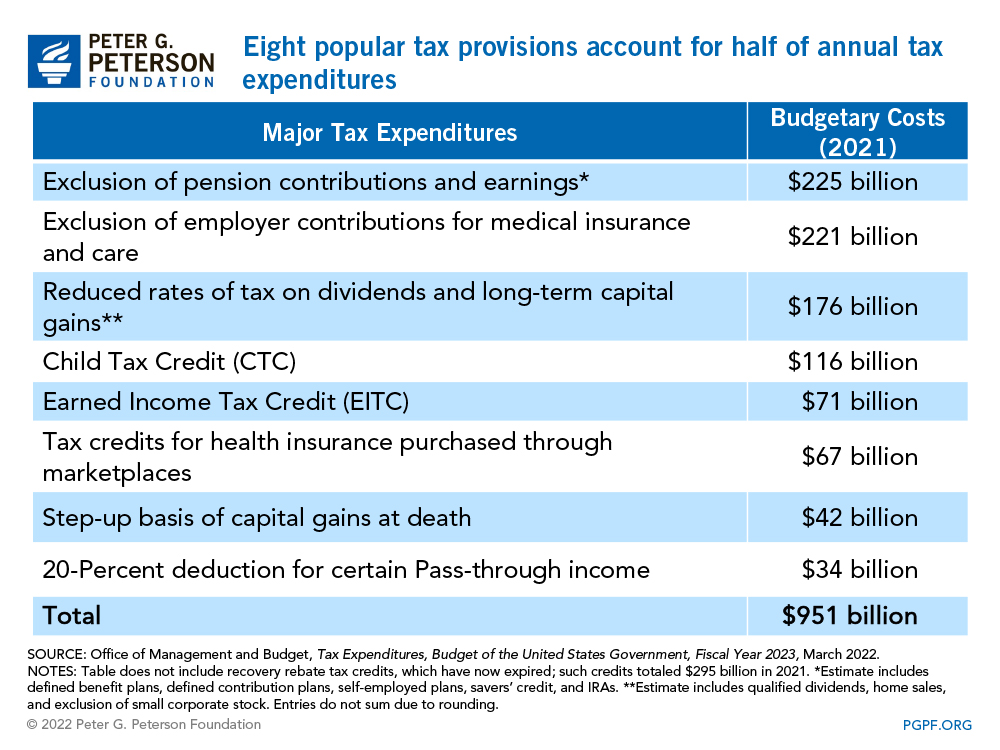

In Georgia however the deduction is. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding soon to avoid an unexpected tax bill or penalty when they file their 2018 federal income tax return in 2019. These deductions tend to be popular with lawmakers and are rarely targeted for outright elimination in tax reform plans.

The phase-out is 315000 for married couples. Federal tax brackets on wages go from 10 percent for the lowest earner to 37 percent for. The age for Required Minimum Distributions RMDs from retirement accounts was raised to 72.

For 2022 your additional premium based on income is as follows. However these deductions are also tilted toward. The maximum tax-deductible contribution for a traditional IRA in 2022 is 6000 if youre younger than age 50.

100 Free Federal for Old Tax Returns. If youre in a higher tax bracket you stand to pay more in short-term capital gains tax when you sell investments. Again the 28 tax rate hits the middle-class.

Single service business owners start getting that 20 phased out with a total taxable income over 157500. The SECURE Act. Moderate to high-income earners may be limited in how much they can contribute to a Roth IRA each year based on their MAGI and tax filing status.

Contributions to a qualified retirement plan such as a traditional 401 k or 403 b. Common Schedule 1 deductions for 2021 are. All individuals that own these types of businesses can qualify for this 20 t ax rate deduction however there are limitations if you own a service business.

Premium Federal Tax Software. 50 Best Ways to Reduce Taxes for High Income Earners. For 2018 the limit is.

For high-income taxpayers however a 28 tax is applied to income in excess of the following amounts. Equal to or below 91000. Previously called above-the-line tax deductions taxpayers can take certain deductions on the 1040 Schedule 1 form.

But for many high earners they. What you pay in addition to your regular Part D premium. For 2021 the max is 58000 and 64500 if you are 50 years old or older.

Short-term capital gains tax is always the same as ordinary income tax rates. Max Out Your Retirement Contributions. All Extras are Included.

The TCJA aligned the long-term capital gains rates of 0 15 and 20 with maximum taxable income levels.

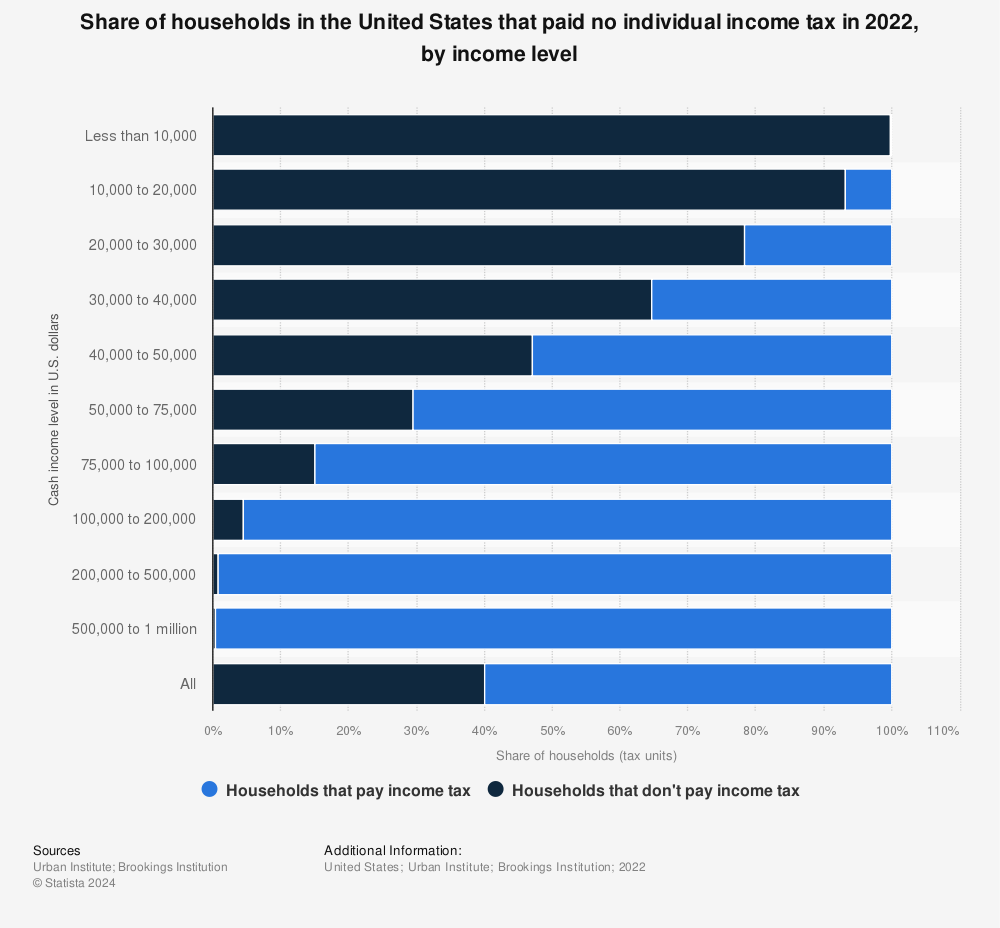

Who Pays U S Income Tax And How Much Pew Research Center

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

Itemized Deduction Who Benefits From Itemized Deductions

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

5 Outstanding Tax Strategies For High Income Earners

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Who Benefits More From Tax Breaks High Or Low Income Earners

How Do Marginal Income Tax Rates Work And What If We Increased Them

Tax Strategies For High Income Earners Wiser Wealth Management

How Fortune 500 Companies Avoid Paying Income Tax

The 4 Tax Strategies For High Income Earners You Should Bookmark

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters